As more private investment firms turn to content and digital marketing, the bar for authenticity is being raised.

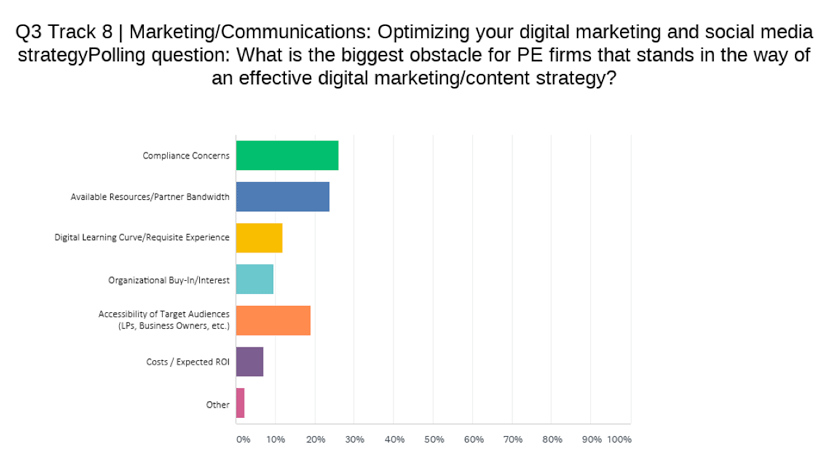

As part of a panel at Private Equity International’s recent Investor Relations & Marketing Forum this past September, delegates were surveyed and asked to identify the biggest obstacle currently standing the way of an effective digital marketing and content strategy. Unsurprisingly, compliance concerns and available resources stood out as the two biggest hurdles. What was revealing, however, was the enduring perception that the most important target audiences – namely limited partners (LPs) and business owners – are perceived to be inaccessible by general partners (GPs).

Speaking on the panel were some of the biggest names in the business when it comes to conceiving digital marketing strategies and creating content, including Devin Banerjee, CFA, Senior Financial Services Editor at LinkedIn; Kathleen Richmond, Director at Serent Capital; and Andrea Williams, a managing director and head of corporate communications and branding at Oaktree Capital Management.

In looking at the survey, the fact that nearly one in five sees LPs and business owners as being impenetrable speaks to the relative nascency of digital marketing within private equity. But the survey also reveals a glaring blind spot in terms of how firms are trying to reach and influence two constituencies so vital to raising capital and sourcing deals. While the panel addressed strategies around compliance, processes, technology, and services core to an efficient content-marketing program, it was the discussion around reaching these specific audiences that can have the biggest impact on raising and deploying capital.

One observation from the panel was that across the board, everyone is witnessing material increases in the number of peers producing thought leadership, the volume of content pieces being created, the frequency at which they’re publishing it, and in the number of channels and mediums being utilized.

However, this influx of thought leadership – in large part triggered by the challenges to network and schedule meetings during the pandemic — makes it all the more imperative that GPs tailor their message to the specific audience being targeted and produce material that delivers a distinct point of view. It’s not that LPs or business owners are impenetrable, but their respective filters are far more discriminating than other constituencies.

For instance, one point discussed was that LPs in particular want predictability when it comes to content. One of the panelists noted preference for a consistent cadence in the distribution of commentary to institutional investors and a “serialized” approach in the topics addressed. LPs, they noted, are also very particular in terms of the content they engage with. Broad themes, offering indistinguishable views on a topic that everyone has a view on, will fall on deaf ears. More discrete subject matter – such as trends specific to a region within Europe for European investors or how a specific strategy might complement a broader alternatives allocation – tend to resonate better and are generally more actionable.

At BackBay, we’ve helped clients develop commentary with one specific prospect in mind, covering a client need unique to a very small subset of the institutional investor universe, even if it outwardly appears like any other top-of-the-funnel content piece. The perspective, then, enables the distribution team to have a more constructive dialogue with key contacts. It can be further pushed out through social media channels, boosted via sponsored campaigns to pinpoint employees at the institution; and published live on the website, where it’s discoverable to similar prospects facing analogous challenges.

But content marketing, one of the panelists observed, should support efforts at every stage of the sales funnel. They noted that their goal initially was to reinforce sourcing efforts geared toward existing prospects, but as their digital marketing program gained momentum, they saw significant traction in inbound inquiries from business leaders and other circles of influence. Post-COVID, the role of content to support existing relationships and maintain a presence among the LPs and business leaders within a firm’s network, also can’t be overstated.

Another theme that came out of the discussion was the power of today’s digital marketing platforms to automate campaigns, track activity at every step of the “client” journey, and optimize outreach through available data. Moreover, social media channels continue to evolve to facilitate more sophisticated content strategies. LinkedIn, for instance, has rolled out LinkedIn Live (to stream videos in real time), LinkedIn Newsletter (with push, in-app, and email notifications that reinforce the reach), and developed better integration with third-party tools, such as Hubspot or Salesforce.

If there are two essential factors in reaching either limited partners or business owners, though, across the panel everyone agreed that it comes down to authenticity and a point of view. The best content isn’t promotional. And advertisements – digital or otherwise – are a far better venue through which to humble brag. The best content, instead, informs and provides a perspective that limited partners and business owners aren’t privy to in their own day-to-day dealings. And authenticity – free from self-promotion – is what resonates with the hardest-to-reach audiences.

It wasn’t discussed on the panel, but authenticity requires a certain amount of vulnerability. Examples can be found in any one of Howard Marks’ memos, but in his most recent commentary, to cite just one example, he admitted he couldn’t make any sense of the GDP numbers. So he took the question another expert who outlined the byzantine – and not-at-all intuitive – path to get to the 32.9% decline recorded in Q2.

Most other distressed debt fund managers would just point to the headline number without any introspection and report that a wave of bankruptcies would be forthcoming. But in divulging what he doesn’t know, and then taking his readers along for the ride as he seeks out the truth and a better understanding, Marks conveys his intellectual curiosity, provides cues around his thoughtfulness and discretion, and entertains his audience much in the same manner as a Malcolm Gladwell or Michael Lewis. Brené Brown would certainly approve, as do Mark’s peers and business partners, who certainly don’t view him as any less of an expert because he didn’t understand something.

So the idea that LPs and business owners are impenetrable really is a myth. The catch is that one thought piece alone won’t break through, especially if the topic addressed doesn’t stand out in a competitive landscape in which everyone has an opinion about the latest Fed actions, economic data, or government policy. It requires a strategy, alignment with the rest of the organization (including compliance), and a champion who relishes the idea of creating content and is willing to explore ideas left untouched by their peers.