As international investors look to snap up ‘undervalued’ UK assets, private equity firms look to brand visibility and storytelling to give them the edge

The recent attempted takeover of Activision Blizzard by Microsoft, which was blocked by the UK’s Competition Markets Authority, was the most visible evidence of a trend taking place across the business ecosystem: U.S. interest in UK businesses. And it’s not just corporates eyeing up UK businesses. According to the law firm Mayer Brown, U.S. private equity firms acquired 35% more UK businesses last year compared to 2021/22.

Valuations for UK companies have been regarded as low for some time, particularly in comparison to those in Europe and the US. A recent analysis conducted for the Evening Standard found that the UK’s top 100 companies would be worth nearly £500 billion more if they were listed on the New York Stock Exchange. Some trace this back to the Brexit referendum in 2016 which caused a long period of uncertainty as new arrangements with the EU were thrashed out and as international investors waited to see how the situation played out.

But it was the volatility that resulted from having three prime ministers in as many months and the turmoil created by the Truss government’s “mini-budget” which sent Sterling spiralling to near parity with the Dollar that really caught the eye of buyers across the Atlantic. Not only were UK companies cheap, but the pound was cheap too, which led to Ares’ Blair Jacobson to tell the FT that “everything in the UK is on sale”. It may not have been a frenzy, but it certainly renewed interest in UK corporates, which has persisted into this year. The relative stability and calm that’s returned to UK politics in recent months has given international investors greater confidence in the UK.

In terms of US private equity interest in the UK, there have been several notable acquisitions in recent months including BlackRock’s investment in mini golf restaurant chain Puttshack and Energy Capital Partners’ acquisition of Biffa, the waste management company, while there are a number take-private deals of UK plcs in the works at the moment, including Providence Equity’s acquisition of Hyve.

But buying a UK company is easier said than done – as Microsoft found out… For them, the issue came at the last hurdle, but for many private equity firms, particularly those outside of the UK, it’s finding the opportunities and getting a foot in the door in the first place. There’s been a spate of US private equity firms opening offices in the UK in recent months to capitalise on the deal-making opportunities – Thoma Bravo, Great Hill Partners and One Rock have all opened offices here in the last 12 months and Apollo last month moved to new London premises as part of its “expanded regional hub”.

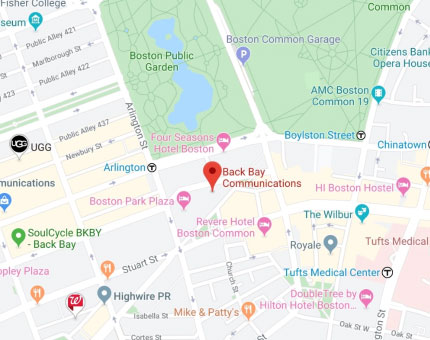

That approach may make sense for the big brand names, but for smaller firms that lack the recognition – and resources – of a Carlyle, Blackstone or Apollo, tapping the market presents more of a challenge. BackBay recently teamed up with SuperReturn to survey private equity firms – the results of which will be released at SuperReturn International in June – and we were surprised to find that generating awareness among CEOs for deal sourcing purposes was the most commonly referenced reason for private equity firms to build their brands, coming in ahead of fundraising/LP awareness.

With private equity firms sitting on record levels of dry powder and amid a slowing fundraising environment, putting capital to work is as important as it’s ever been. In a highly competitive deal-making environment, brand recognition and understanding is a key ingredient in the process. It won’t get a deal done, but it might start a conversation.

In addition to publicising deals, exits and fundraises, we’re increasingly finding that our private equity clients are looking for new ways to tell their stories. Whether it’s through case studies, providing a deep dive into the deals they’ve done and their value creation approach, better utilising LinkedIn as a thought leadership platform, developing thought leadership articles, videos and other content on the sector and geographic trends they’re seeing, or developing profiles on team members, there’s a greater focus on projecting what the company stands for and why they are a good long-term partner to drive growth, beyond purely communicating the financials.

And they’re embracing a wider range of channels too. Social media, video and podcasts are increasingly sitting alongside traditional website content and media relations as part of the mix as firms look to take their message to a broader audience that consumes information in different ways.

As private equity becomes a bigger part of the financial system and a bigger part of everyone’s lives, the importance of brand recognition and storytelling will only become more important.